1. The Crypto User Do’s & Don’ts When Trading.

- Research and plan your trade

- Invest on what you can afford to lose

- Monitor Bitcoin’s price movements

- Only use reputable exchanges

- Don’t fall for a scam

- Don’t do panic selling

- Do not be emotional

- Don’t be greedy

2. The Crypto Users Do’s & Don’ts When Storing.

- Use a safe coin storage

- Enable 2 Factor Authentication (2FA)

- Back up your wallet

- Do not share your private key

- Do not leave your hardware wallet plugged

- Do not download a new crypto wallet that hasn’t been tested yet

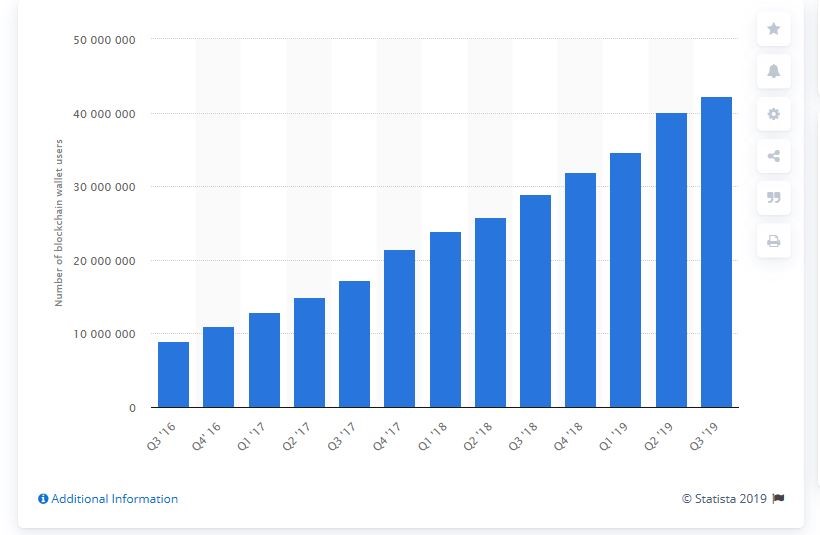

Cryptocurrency wallets are required in order for crypto users to store and hold their coins and tokens. As a matter of fact, there has been an increased number of cryptocurrency wallet creation from 2016 to 2019.

The total number of cryptocurrency wallet users has increased to over 40 million by Q3 2019, portraying a considerable huge increase from less than 10 million users in Q3 2016. This rapid growth is a strong indication of how fast the popularity of digital assets has escalated.

A more detailed graph prepared by market and data provider Statista confirms the growth of crypto wallet users from 2016 to 2019.

Setting up your own wallet is one of the requirements for anyone who wants to enter the crypto world and nowadays there is a wide and expanding choice of cryptocurrency wallets available. It allows you to store, acquire, and make use of your digital assets the way that you want to. But owning your own crypto wallet is just the beginning. Make sure that you are on the right track to prevent encountering any cybersecurity threats.

We have listed down some tips that you should do when trading and storing your cryptos. On the other hand, we have gathered some situations you need to pay attention to and avoid doing as much as possible.

To ensure a smooth and secure crypto user experience, you must keep in mind the following:

1. The Crypto Users Do’s When Trading:

Research and plan your trade

Doing research is the very first step that you should do before you get into the world of cryptocurrency trading. Choose the cryptocurrency you want to invest on and make an effort to know the background, market performance, and the team working behind the project. Have the discretion to do this as there are so many cryptocurrencies out there with good marketing strategies that appear to be more than what they actually are.

Don’t be easily convinced of what you can see on a project’s whitepaper. Do in-depth research and spend time analyzing the details thoroughly. Remember that a good cryptocurrency must have a purpose and future value; not just a stylish website or catchy name.

Let’s now consider that you have finally made up your mind in which crypto to buy and trade.

Compare to forex charts, crypto charts move faster in an unpredictable manner which is why using stop losses is very recommendable when trading. If you already reach your desired percentage, do not be greedy and take your profit. After this, go back to the first step of the trading cycle: research and keep yourself updated on the recent happenings within the industry.

Invest on what you can afford to lose

There is a significant difference between saving and investing. Saving is when you put your money in a safe place and you keep it there for a certain period of time (might be a few months or several years). It might earn a little interest depending on the agreement you have with a certain bank or financial institution.

On the other hand, investing in the process of making your money work for you. When done properly, it can generate a great amount of money that is even bigger than the interest you could earn in your bank savings account in a year.

There are still a lot of people who get scared of the idea of ‘investing’ their money on something, especially if we put it into the cryptocurrency context. But if you start with a small capital and let it grow over time, you have nothing to worry about.

If you are a newbie investor, you should invest only the extra money you have, not the money within your budget.

Both saving and investing is a great way to make your money work for you and earn profit instead of letting it sleep inside your coin bank or wallet. But always keep in mind the golden rule that never invests an amount of money that you cannot afford to lose.

Monitor Bitcoin’s price movements

Bitcoin, aka the grandfather of cryptocurrency, is the most widely-adopted crypto asset at present. It is supported by all crypto exchanges as a trading pair for the listed altcoins available on their platforms. Bitcoin has a significant effect on the price movements in the market. If Bitcoin is bullish, then most likely the altcoin prices will also rocket too, and vice versa.

Bitcoin has been proving itself as one of the most practical forms of digital money that can be used in paying bills, buying food, and making online purchases. Many large companies such as Microsoft, KFC Canada, AT&T telecom USA, and T-Mobile Poland started to accept Bitcoin as payment for their goods and services.

Even the e-commerce giant Amazon also considers accepting Bitcoin as payment. You can use Bitcoin to buy products off Amazon by using Purse.io to process your Bitcoin payment upon purchase.

These are just a few things where Bitcoin plays an important role and also one of the reasons why crypto users should follow and monitor the Bitcoin’s market performance.

Only use reputable exchanges

Upon trading, knowing the most secure and suitable exchanges for you is very important. There are over 500 crypto exchanges in the fintech market, but the real challenge is identifying the most authentic and safest exchange for your cryptocurrency.

Once you are already sure about which digital asset you want to buy, it is important to only transact on reputable and stable exchange platforms. Apparently, the majority of exchanges are not transparent as they do not provide much detail on how they operate, how they are funded, and how they handle their cybersecurity.

In the 2nd quarter of 2019, approximately $4.26 billion was stolen from digital asset exchanges that cost a huge loss for investors and exchange users.

Dealing with unguaranteed cryptocurrency exchanges with a history of hackings, technical failures, and inconsistencies can lead you to unexpected loss of funds. Therefore, it is really important to conduct extensive research about the platform of your choice before entrusting your funds on it.

The Crypto Users Don’ts When Trading:

Don’t fall for a scam

The simple rule is “if it looks too good to be true, think twice before investing.”

There are different types of crypto scammers that are prevalent since the birth of bitcoin. These criminals use both new and old fashioned tactics to swindle and execute their malicious schemes through various blockchain-based projects and their digital currencies. Some of them manipulate people by promising big returns in a very short period of time.

Unfortunately, we cannot stop scammers who take advantage of people’s weaknesses for a living. But crypto users can avoid all these scammers if you practice due diligence and do your research before purchasing any digital assets.

Do not be fooled by unrealistic returns and claims through press releases, spam emails, telemarketing calls or social media trends. These are clear signs of a classic “pump and dump” fraud.

Check out one of our ABBC Security blogs that talks about crypto scam advisory and other types of fraudulent activities you must stay away from.

Don’t Do Panic Selling

Panic selling is a common term you usually see on various bitcoin communities and forums. This is something that many crypto users tend to face whenever the price of a certain cryptocurrency drops, even by a small percentage.

Panic selling starts as new traders begin to sell their cryptocurrency in fear of a bigger drop where they might make a loss. It must be kept in mind that when a large number of people began to panic sell, the price of the cryptocurrency automatically drops.

Always remember that there are many price fluctuations in the cryptocurrency market over time and most of the popular cryptocurrencies recovered in a short term period.

Do not panic. What you can do is track and monitor the latest news about the cryptocurrency and the changes in its volume. Price drops in the crypto market do happen so it is also suggested that you observe first on the price movement before selling your crypto assets.

For instance, Bitcoin fell from $4400 in August 2017 to $2900 in September 2017 and when it recovered, it broke the all-time-high records and rocketed up to $7500 in November 2017.

Do not be emotional

Do not let your emotions interfere in your daily trading lives just because you heard some bad news about certain crypto or the general market. Letting your emotions consume you can lead to a decision that could end up really bad and make you miss out on great opportunities.

As humans, we hate these emotions and when we feel them, the first thing that comes up to our brain is to stop feeling them. Emotional traders tend to gain small and lose big as they tend to follow their “gut” feelings than considering the logical reason behind a sudden price movement in the market.

These strong emotions can sometimes drive you to continue trading rather than to stop and walk away despite the high risk that is being shown by the figures.

This physiological tendency is normal when we are in an emotional state. We suggest that you can just take your loss and walk away. Remember that trading requires patience and perseverance and everybody experiences some loses along the way.

“Don’t let your emotions drag you to a deeper downfall.”

Don’t be greedy

“Bulls make money, bears make money, pigs get slaughtered”. This Wall Street saying serves as a warning to investors who might tend to be greedy.

In the cryptocurrency world, there is no such thing as losing while making a profit. As the cryptocurrency grows its price, the more we become greedy on reaping higher profits. There are several ways of getting higher profit in crypto trading and being greedy is not one of them.

For example, if the cryptocurrency raised its profit by 25%, why not consider this profit margin even if the profit limit is set to 40% – 50%? In that way, you can at least earn something rather than waiting too long to get a higher ROI that could end up turning your profit into a loss.

Take into consideration that the cryptocurrency market is volatile in nature. Cryptocurrency prices can go higher in a matter of seconds but it can also go down enough to drag you deeper to an end.

2. The Crypto Users Dos When Storing:

Use a safe coin storage

Nowadays there are so many kinds of wallets where you can store your crypto and it is up to you to choose which one you will use. A great wallet must possess a robust security feature. Commonly, there are two kinds of wallets: the hot wallet and the cold wallet.

A hot wallet is connected to the internet. Technically, this type of wallet accepts more coins and is easier to be set up. While cold storage is a type of wallet that can function without the internet. Since it is offline, it keeps you away from the malicious influence that hackers can do.

Both storages have their own unique pros and cons, and it is up to you to decide which is the best wallet that fits your lifestyle and security needs. Below is a comparison between hot wallets and cold wallets:

| Hot Wallet | Cold Wallet | |

|---|---|---|

| Pros |

|

|

| Cons |

|

|

With these in mind, you can now choose your preferred crypto asset storage that you think will be best for you.

Enable 2 Factor Authentication (2FA)

After choosing the right wallet to store your valuable cryptocurrency, it is also vital to add a security layer on your crypto wallet. The two-factor authentication (2FA) or sometimes called multi-factor authentication adds an extra layer of security to your cryptocurrency wallet.

By enabling this feature, you enhance your wallet protection against malicious hackers. The 2FA protects your assets by allowing you to be informed of any suspicious activity like login attempts or sending transactions.

There are different types of 2FA that are used to provide a secondary form of authentication. These include Google authenticator, Microsoft authenticator, and Authy. The Google authenticator is the commonly used 2FA mechanism. This is where a unique OTP must be submitted to successfully login or conduct transactions on your account.

With the growth of the issues regarding internet frauds, digital crime, and security breaches on different types of industries, it is important to provide your wallet great security that can prevent unwanted damages that you might encounter anytime.

Back up your wallet

Unfortunate and unexpected incidents can happen at any time. Incidents such as your device being lost, stolen, damaged, or subject to a software malfunction, emphasizes the need to back up your wallet on a regular basis. This will ensure the safety of your crypto funds and data.

There are several types of procedures on how to back up your wallet. The most common procedure is by utilizing the built-in crypto wallet backup feature on the app. For instance, the Aladdin Mobile integrates a Cloud backup feature to provide users a more accessible and secure way of backing up their wallets.

In addition, having a wallet backup grants you peace of mind, knowing that you can retrieve your funds and other data or transactions despite the loss or damage of your device.

The Crypto Users Don’ts When Storing:

Do not share your private key

There is a saying that “If you don’t own your private keys, you don’t own your crypto.”

Having said that, private keys should be protected at all costs. This is where the difference between custodial and non-custodial wallets becomes relevant.

In exchanges, a custodial wallet can be accessed. Custodial, in this sense, means that you are allowing a third-party to have access to your private keys. This is a bit risky for users who want to hold their cryptocurrencies for the long term.

The Mt. Gox exchange incident in 2013 has left a mark within the crypto industry. This is where 850,000 worth of BTC was hacked due to stolen private keys. This is just an instance of what can possibly happen upon losing your private keys.

By choosing a non-custodial wallet, you are ensured that no one shares the wallet with you. There are no third parties that can get a hold of your wallet’s private keys.

Always remember that losing your private is like losing your funds. Keep your private keys secured and make sure that no one can access it except for you.Private keys are like your gateway in accessing your wallet and conducting transactions with your crypto funds.

Do not leave your hardware wallet plugged

Opt to use a hardware wallet for your crypto funds especially if you are holding a huge amount of digital assets. As mentioned above, hardware wallets are wallets that keep your digital assets on offline storage and can be used even without any internet connection.

Without using an internet connection, your wallets are protected from the hand of malicious hackers that aim to steal your account and digital assets. In spite of being offline, do not be too complacent as there are ways for hackers to penetrate your account.

Never leave your hardware wallet plugged in your computer for a long time. As soon as your done using it, remove it and close the app you are using.

Following these simple steps can prevent your wallet from catching malware viruses that can open an opportunity for hackers to get a hold of your digital assets. Stay alert to keep your crypto wallet safe at all times — with or without the internet.

Do not download a new crypto wallet that hasn’t been tested yet

There are over 30 million crypto wallets in the market. There are wallets that have been marketed well and have integrated handy features, but there are also those that have no clear plans and will just leave you empty-handed.

Before downloading and using any wallet, do your research regarding the wallet that you will choose. Read reviews, blogs, and articles regarding the wallet and check also how long the app has been operating and who were the developers.

With these procedures, you can somehow be confident on the wallet app that you are about to download. Always keep in mind that choosing the right wallet is also as good as having your crypto investment in good hands.

Conclusion: Protect Yourself and Secure your Assets

Be protected at all times to reduce the chances of you getting victimized by identity frauds and hackers aiming to gain control of your cryptos. Privacy is becoming an issue as it tends to be compromised as technology innovates.

ABBC Generation 2 upgraded its consensus mechanism to Delegated Proof-of-Stake (DPoS) to make its blockchain better and more scalable. The network utilizes DPoS benefits that include better security and transparency.

The ABBC team redefines crypto security by releasing the new Aladdin Pro Wallet.

The Aladdin Pro Wallet is ideal for professional traders and long-term crypto users. It is a multi-currency blockchain wallet that provides a multilayered security system which includes unique mobile device number identification, biometrics, voice recognition, and transaction password. By using this wallet, crypto users can send and receive funds seamlessly, within a short period of time.

When trading and storing, it is important to prioritize the safety of your cryptos. Be smart in handling your cryptos to have a safe and worry-free crypto trading experience.